Indirect Cost Policy

For awards subject to OMB Uniform Guidance, 2 CFR Chapter I, Chapter II, Part 200 et al.

The National Fish and Wildlife Foundation (NFWF) recognizes that in some instances award subrecipients might have costs that are not directly attributable to projects or activities being funded by the Foundation, but that the recovery of those indirect costs is necessary in order to effectively implement the respective projects or activities. In those situations, the following indirect cost policy applies. Please review the Definitions (D) Frequently Asked Questions (E), and Appendix sections of this document for more information.

A. INDIRECT COST POLICY

- Applicant/subrecipients with an approved federally recognized and valid Negotiated Indirect Cost Rate (or Recovery) Agreement (NICRA) from their cognizant agency can charge indirect costs to projects based on their negotiated indirect cost rate and modified total direct cost (MTDC) base, both as listed in their NICRA.

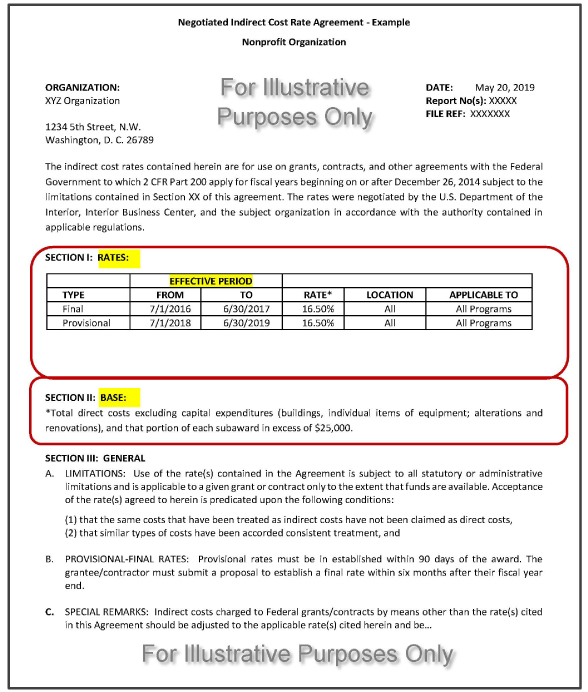

- An approved and valid NICRA is one in which the rate has been authorized by a cognizant agency and the effective period has not expired. Valid provisional, final or fixed NICRAs will be accepted. Applicants/subrecipients must provide a copy of their approved and valid NICRA with their application in order for indirect cost reimbursements to be considered.

- The federal government has determined that an up to 15% de minimis indirect rate is an acceptable minimum for organizations without a NICRA, as such NFWF reserves the right to scrutinize ALL proposals with indirect rates above 15% for cost-effectiveness.

- If the effective period indicated in the applicant/subrecipient's NICRA has expired but there is documented evidence (at the time of NFWF fiscal review) that an Indirect Cost Rate Proposal or application for extension has been submitted to the cognizant agency and the approved rate is pending, the applicant/subrecipient may elect to accept a rate of up to 15% of MTDC (Uniform Guidance Definition). The excess of the elected rate and the rate in the entity's Indirect Cost Rate Proposal will be held back until an approved NICRA is issued. Once received, the rate and MTDC base indicated in the approved NICRA will apply to the project budget. If the Indirect Cost Rate Proposal is not approved by the cognizant agency during the NFWF sponsored project's period of performance, the elected indirect cost rate of up to 15% of MTDC (Uniform Guidance definition) will apply and no indirect costs in excess of 15% of such MTDC can be recovered. (See section B.2)

- Adjustments to indirect costs are valid only through the effective period of the rates as shown in the NICRA. Rates can neither be retroactively applied to periods prior to the effective period in the NICRA nor to prior fiscal years of the subrecipient.

- "No-Cost Extensions" cannot be requested or approved in order to hold projects open until NICRAs are approved.

- In cases where calculated indirect costs require adjustments, the applicant/subrecipient acknowledges that neither the scope of work nor the total award amount for the project can change.

- If the effective period indicated in the applicant/subrecipient's NICRA has expired and there is no documented evidence that an application for a new rate or extension is pending, (at the time of NFWF fiscal review) the applicant/subrecipient may elect to negotiate a rate with NFWF. The rate available is up to 15% of MTDC (Uniform Guidance definition). This rate is final and cannot be renegotiated during the project lifecycle. (See section B.3)

- Entities that have never had a NICRA may elect to recoup a de minimis indirect cost rate of up to 15% of MTDC. (See section B.4)

- The Foundation may request additional information in order to determine if a proposed expense is an appropriate direct or indirect cost.

- NFWF, at its discretion, reserves the right to determine the appropriate allocability of indirect cost charges.

B. RATE APPLICATION

The following table illustrates the appropriate rate to use when applying indirect costs to projects:

| NICRA Status | Applicable Rate | Applicable Base/MTDC | Indirect Adjustment |

| 1. Approved & Valid NICRA | Rate defined in NICRA |

Base as defined in NICRA | N/A |

| 2. Expired NICRA with a Renewal Rate or Extension Application Pending |

up to 15% (entity’s accepted maximum rate with NFWF) |

MTDC (Uniform Guidance Definition) = MTDC means all direct salaries and wages, applicable fringe benefits, materials and supplies, services, travel, and up to the first $50,000 of each subaward (regardless of the period of performance of the subawards under the award). MTDC excludes equipment, capital expenditures, charges for patient care, rental costs, tuition remission, scholarships and fellowships, participant support costs and the portion of each subaward in excess of $50,000. Other items may only be excluded when necessary to avoid a serious inequity in the distribution of indirect costs, and with the approval of the cognizant agency for indirect costs. (§200.68) | Per A.2 only, New Rate and Base applies for the effective period of the new NICRA and forward (not retroactive). |

| 3. Expired NICRA without a Renewal Rate or Extension Application Pending |

up to 15% (entity’s accepted maximum rate with NFWF) |

MTDC ( Uniform Guidance Definition) = .MTDC means all direct salaries and wages, applicable fringe benefits, materials and supplies, services, travel, and up to the first $50,000 of each subaward (regardless of the period of performance of the subawards under the award). MTDC excludes equipment, capital expenditures, charges for patient care, rental costs, tuition remission, scholarships and fellowships, participant support costs and the portion of each subaward in excess of $50,000. Other items may only be excluded when necessary to avoid a serious inequity in the distribution of indirect costs, and with the approval of the cognizant agency for indirect costs. (§200.68) |

N/A |

| 4. Never Had a NICRA |

up to 15% (de minimis rate per Uniform Guidance) |

MTDC (Uniform Guidance Definition) = MTDC means all direct salaries and wages, applicable fringe benefits, materials and supplies, services, travel, and up to the first $50,000 of each subaward (regardless of the period of performance of the subawards under the award). MTDC excludes equipment, capital expenditures, charges for patient care, rental costs, tuition remission, scholarships and fellowships, participant support costs and the portion of each subaward in excess of $50,000. Other items may only be excluded when necessary to avoid a serious inequity in the distribution of indirect costs, and with the approval of the cognizant agency for indirect costs. (§200.68) | N/A |

View a PDF version of this chart here.

C. INDIRECT COST CALCULATION

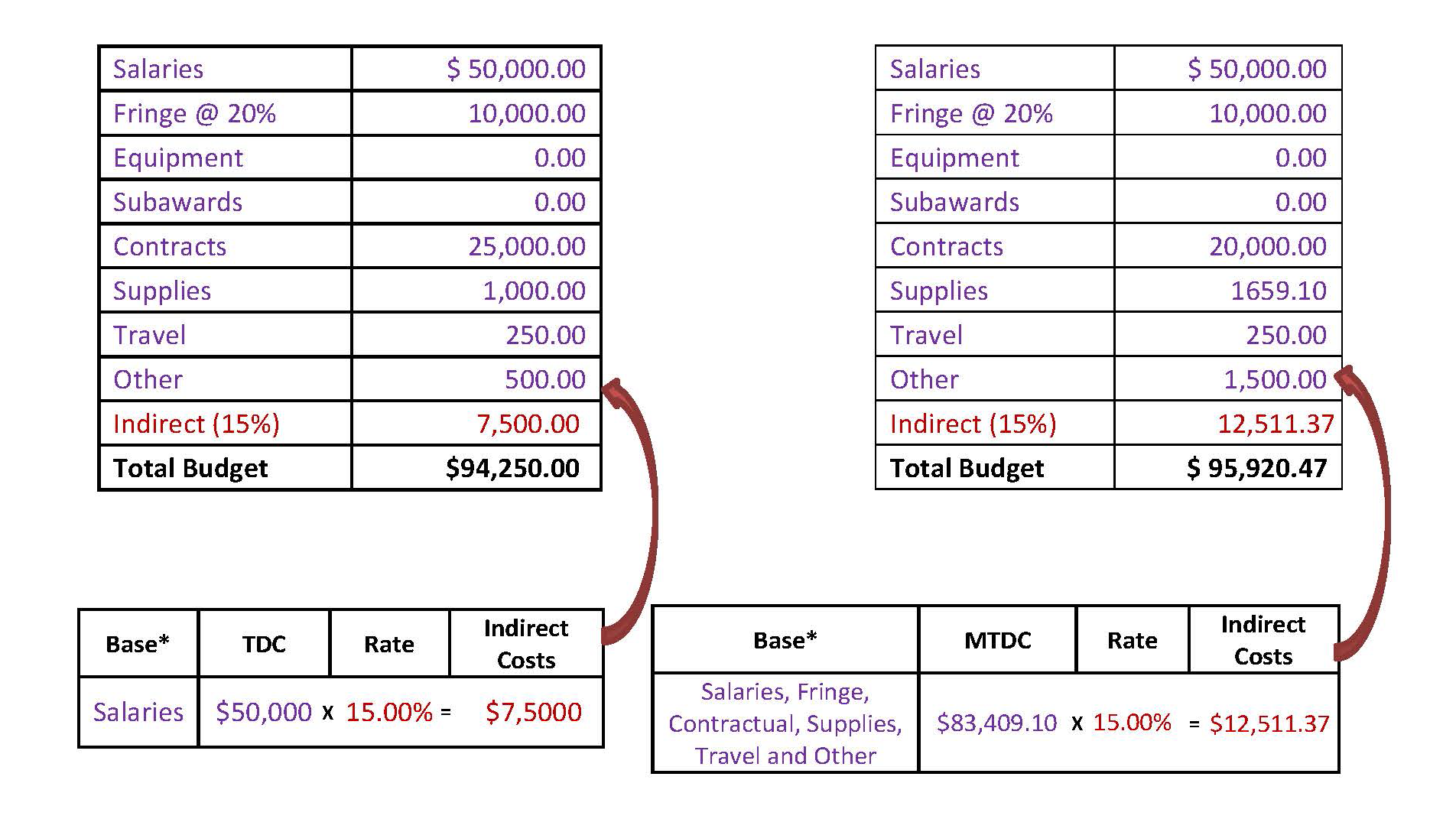

Indirect costs must be calculated using the cost base defined in the organization's NICRA. Entities without a valid and approved NICRA must use the appropriate base defined in section B.2, B.3, or B.4 of this policy. The cost base formula will result in the calculation of the modified total direct cost which will then be multiplied by the negotiated indirect cost rate. The resulting calculation represents the indirect cost allowable for the project. Learn more and download NFWF's Indirect Cost Calculator.

D. DEFINITIONS

Base – formula specified in an entity's NICRA that defines the appropriate MTDC for use when calculating indirect costs applicable to a project, program or outcome

Capital Expenditures – expenditures for the acquisition of capital assets (equipment, buildings, and land) or expenditures to make improvements to capital assets that materially increase their value or useful life

Contract – a legal instrument by which an entity purchases property or services needed to carry out the project or program under an award.

Cost Allocation Plan (CAP) - generally used in lieu of an indirect cost rate proposal. A CAP may be necessary when substantial direct costs of programs consist of joint or common cost distributions and/or when the nature of the subrecipient's activities is such that direct costs cannot be adequately determined with reasonable precision. In such situations, use of a CAP may be more suitable than an indirect cost rate. A CAP (if required) should be submitted to the cognizant federal agency

Cognizant Agency – the federal agency responsible for negotiating and approving indirect cost rates and applications for extensions on behalf of all federal agencies

Direct Costs – costs that can be attributed specifically to a particular project, program, activity or final cost objective

Documented Evidence – a copy of the complete indirect cost rate proposal application submitted in order to recover indirect costs. Must include complete signed proposal with the date submitted

Effective Period – Period identified in the NICRA agreement that indicates the dates for which the approved indirect rate is valid

Equipment – an asset (including information technology systems) with a useful life of more than one year and a per-unit acquisition cost greater than or equal to $10,000

Indirect Cost Rate Proposal – the documentation prepared by an organization to substantiate its claim for the reimbursement of indirect costs. The proposal provides the basis for the review and negotiation leading to the establishment of an organizations indirect cost rate by their cognizant agency

Indirect Costs – costs incurred for a common purpose, benefitting more than one objective, project or program and cannot be easily assignable to the outcome, project or program specifically attaining the related benefits.

Modified Total Direct Costs (MTDC) Uniform Guidance Definition – calculation of project direct costs excluding cost items as identified in the entity's NICRA (base definition), or as defined in §200.68 of the Uniform Guidance if a valid and approved NICRA does not exist. The MTDC base can vary by organization.

Negotiated Indirect Cost Rate (or Recovery) Agreement/ NICRA – agreement negotiated between an entity and their cognizant federal agency regarding the "fair share" of indirect costs that can be charged to federally funded projects. Federal, state, local governments and Indian tribes may submit an authorized Cost Allocation Plan (CAP) in lieu of a NICRA

Rate Types – there are four types of negotiated indirect cost rates:

- Provisional rate – temporary indirect cost rate applicable to a specified period which is used for funding, interim reimbursement and reporting indirect costs on awards pending the establishment of a final rate for the period

- Final rate – an indirect cost rate applicable to a specified past period which is based on the actual costs of the period

- Predetermined rate – an indirect cost rate that applies to a specific current or future time period and cannot be adjusted except under unusual circumstances

- Fixed rate (Fixed Carry Forward) – an indirect cost rate which has the same characteristics as a predetermined rate, except that the difference between the estimated costs and the actual costs of the period covered by the rate is carried forward as an adjustment to the rate computation of a subsequent period.

Subaward – an award provided by a pass-through entity to a subrecipient for the subrecipient to carry out part of an award received by the pass-through entity

Unallowable Costs – costs that are expressly prohibited from being charged to a project (i.e. alcoholic beverages)

Unrecoverable Costs – allowable costs that cannot be charged to a project due to a funder or NFWF imposed restriction or cost maximum

E. FREQUENTLY ASKED QUESTIONS

Q1. How do I determine my cognizant agency?

Generally, the cognizant agency is the federal agency from which you receive the most federal financial assistance. NFWF does not serve as a cognizant agency or process negotiated indirect costs rate applications.

Q2. How do I apply for an indirect cost rate?

Work with your cognizant federal agency for procedures on applying for an indirect cost rate.

Q3. What if our entity does not have a NICRA?

If your entity does not have a valid NICRA, see Section A in the above Policy.

Q4. What documentation is required to verify that my entity has a valid NICRA?

When applying for a NFWF award, applicants must attach a copy of their current/valid NICRA. If the NICRA is expired, also provide the expired NICRA and the most recently submitted Indirect Cost Rate Proposal or Cost Allocation Plan for the appropriate period to be covered or application for extension. ALL proposals with indirect rates above 15% for cost-effectiveness. See Section A above.

Q5. When can administrative, overhead, or operational costs be directly charged to a project?

If a cost can be shown to be directly attributable to a specific project or program it may be considered a direct cost.

Q6. Can unrecovered indirect costs be treated as match/cost share?

Yes, unrecovered indirect costs may be included as part of cost sharing or matching only with the prior approval of the Federal awarding agency or the National Fish and Wildlife Foundation as the pass-through entity. Unrecovered indirect cost means the difference between the amount charged to the award and the amount which could have been charged to the award based on your organization’s federally approved negotiated indirect cost rate (NICRA), or the de minimis rate.

Q7. Can existing equipment, insurance or maintenance costs be charged directly to a project?

Generally no, these costs are considered indirect costs and would be recovered via an indirect cost rate if applicable.

Q8. Can government agencies charge indirect costs to a project?

Yes, if the agency has an approved Cost Allocation Plan (CAP) or NICRA. Additionally, agencies required to fully recover direct and indirect costs can do so with documentation of authorization from their agency's Director. Section A of the policy above applies to both NICRAs and CAPs. Note, however, NFWF reserves the right to scrutinize ALL proposals with indirect rates above 10% for cost-effectiveness.

Q9. What does a Negotiated Indirect Cost Rate Agreement look like?

This may differ by cognizant agency, however an example is provided in Appendix 1 of this document.

Q10. What MTDC base should be used to calculate my entity's indirect cost?

The base defined in your entity's NICRA should be used. If no NICRA exists, the base defined in Section B of this policy.

Q11. Who at NFWF do I contact if I have questions about allowable or allocable indirect costs?

Please contact the Program Manager or Grant Administrator assigned to your project for specific questions. For federally funded projects, costs must be in compliance with the applicable OMB guidelines.

Q12. Can NFWF subrecipients allow indirect costs to be charged to projects that they award to their subrecipients under the same program/project?

Once NFWF has awarded funds to a direct subrecipient, the determination to allow the next tier subrecipient to charge indirect costs to the project or program must be made by the direct subrecipient, in compliance with the applicable OMB guidelines.

Appendix 1

If you have questions concerning your application, please contact the staff member listed in your RFP. You can also email info@nfwf.org.